My point is that my ‘belief’ is not baseless. It’s kinda saying that ‘global warming’ is not a problem as it’s just a belief despite the signs that it is. Waiting for it to become ‘fact’ is a problem.

There’s been a study on it as I linked earlier by some pretty smart people.

I quote its conclusions:

We have argued that deviant mining strategies in a transaction fee regime could hurt the stability of Bitcoin mining and harm the ecosystem. In a block chain with constant forks caused by undercutting, an attacker’s effective hash power is magnified because he will always mine to extend his own blocks whereas other miners are not unified. This would make a “51%” attack possible with much less than 51% of the hash power.

Many other unanticipated side-effects may arise. In the block size debate, it is frequently argued or assumed that space in the block chain will be a scarce resource and a market will emerge, with users being able to speed up the confirmation of a transaction by paying a sufficiently large transaction fee. But if miners intentionally “leave money on the table” when solving blocks, as is the case in undercutting attacks, it breaks this assumption. That is because undercutting miners are not looking to maximize the transaction fee that they can claim, and don’t have a strong reason to prioritize a transaction with a high fee.

Put another way, the block size imposes a constraint on the total size of transactions in a block and the threat of being undercut imposes another constraint on the total fee. The two interact in complex ways. We believe that qualitatively our results will continue to hold in a world where the available block size is much smaller than the demand, but quantitatively the impact of undercutting will be mitigated (see end of Section 3.1). Still, it is an important direction for future research to

understand this connection more rigorously.Despite the variety of our results, we believe we have only scratched the surface of what can go wrong in a transaction fee regime. To wit: we have not presented an analysis of miners whose strategy space includes both undercutting and selfish mining, primarily due to the complexity of the resulting models. There has been scant attention paid to the transition to a transaction-fee regime. The Nakamoto paper addresses it briefly: “The incentive can also be funded with transaction fees… Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free”. Similar comments on the Bitcoin Wiki and other places suggest that the community views the transition as unremarkable. Some altcoins (Monero, Dogecoin) have even opted to hasten the block reward halving time.

Our results suggest a different view. We see the block reward as integral to the stability of the mining game. At a minimum, analyzing equilibria in the transaction-fee regime appears dramatically harder than in the block-reward regime, which is a cause for concern by itself. The monetary inflation resulting from making the block reward permanent, as Ethereum does, may be a small price to pay to ensure the stability of a cryptocurrency.

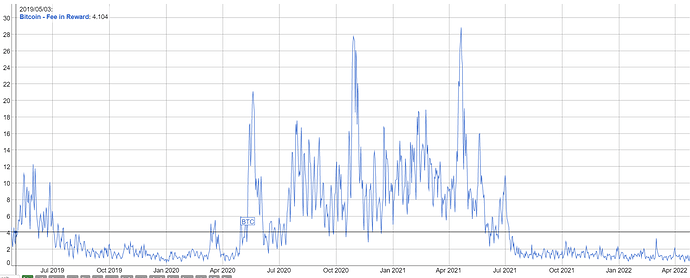

Let’s look at real figures. Ideally we would want to start seeing the creation of a fee market as time passes. Unfortunately, fees as a % of the block reward have actually have been dropping.

Source: https://bitinfocharts.com/comparison/bitcoin-fee_to_reward.html#3y

You mentioned that the fees instead will be mostly opening and closing of lightning channels and it’s a future whereby only settlements happen on the base layer while most transactions happen on the lightning layer. Does that mean that a regular Joe would need to pay this expensive one off cost to onboard onto lightning? And then need to pay someone enough out to have sufficient inbound liquidity or use one of these methods? Or use a centralized service that incurs yet more fees to create this inbound liquidity?

Sounds like a permissioned system instead of the ‘anyone can create a wallet’ and receive/send money immediately.