This has been a request from several community members in the other polls on the Firo block reward division thread. This not a core team initiated proposal though we thought it was an interesting enough idea to seek community feedback.

If this thread gains sufficient traction, we’ll open a poll for it.

The proposal is simple, with the halving of the block time, keep the token emission the same per block which is currently at 12.5 FIRO/block. This effectively accelerates token emission.

THE PURPOSE OF COIN EMISSION

The purpose of coin emission is a way to distribute coins and bootstrap community. Emission can also be used to fund incentives of behaviour/initiatives we want to see for e.g. mining, masternodes or liquidity incentives.

While coin emission is inflation, the difference between fiat inflation which are determined by the central bank, cryptocurrency supply schedules are social contracts with the community. Some pride themselves in never deviating (such as Bitcoin) while others adjust as need be as long as there’s community consensus (see ETH and XMR).

Also there’s economic theory (Quantity Theory of Disaggregated Credit) that if coin emission is used for productive purposes it can generate a net benefit despite the inflation.

HOW DOES FIRO’S EMISSION SCHEDULE LOOK LIKE COMPARED TO OTHER COINS?

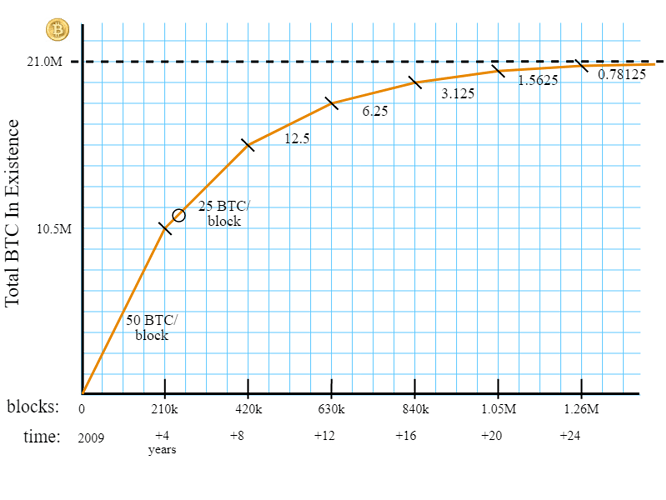

Firo’s block emission schedule currently follows Bitcoin’s schedule which is an extremely slow emission schedule.

As you can see, the coins are emitted over a very long period of time and only approaches close to complete distribution in 20+ years from its creation. It however absolutely completes distribution in 2140. This was important as Bitcoin operated in a vacuum and all the crypto and industry infrastructure had to be built around it. This isn’t the same environment we have today with most of the population being aware of the existence of cryptocurrencies, well developed exchanges, rapidly growing DEXes and professional miners.

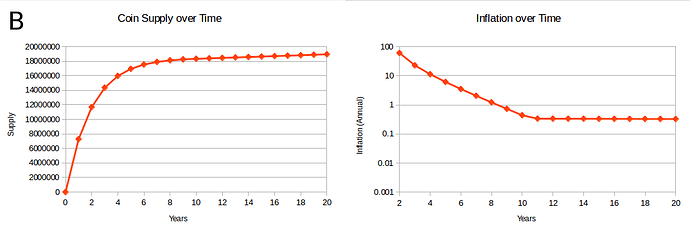

Compare this to Monero’s emission schedule which emits most of its supply in almost 6 years and is now entering into its tail emission phase.

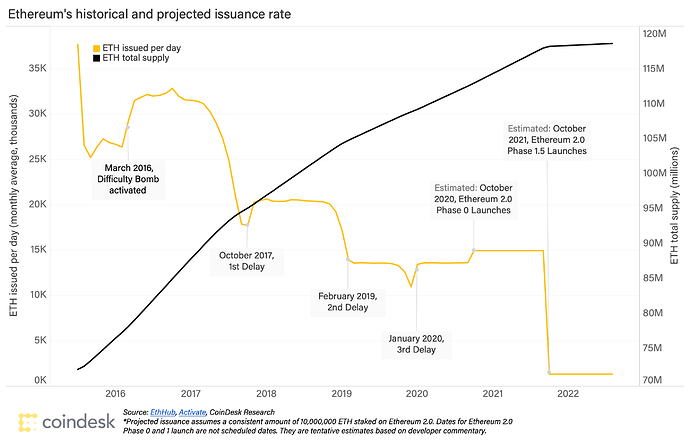

Ethereum also has a similarly aggressive schedule:

Piratechain’s emission is also almost completely emitted in 2 years.

PROS OF ACCELERATING COIN EMISSION

With the proposed changed in tokenomics coming to a close soon, the miners are taking a 50% hit which may affect the current ecosystem. If we don’t change the block reward per block but accelerate the block time, the miners will get the same amount of FIRO as they did currently which would sustain the

This will also greatly alleviate core team funding issues and greatly empower the community fund. While this is additional inflation, if they are dedicated towards productive uses, the net benefit it will yield might be more especially as both the community and the development team has funds to allocate.

Masternodes will also enjoy a much larger yield making it competitive with other staking programs. However the effect of this is dependent on whether masternodes will utilize these rewards to create more masternodes, contribute towards the ecosystem or just sell them. If it’s the latter, then it’s inflationary pressure.

This cuts a balance and doesn’t change the dev team’s share of the reward nor does it involve willing coins out of thin air. This also preserves the existing PoW infrastructure without resulting in even more centralization of pools. Note that despite miners dumping, even with current selling pressure, they only exert something like 10k USD sell pressure a day so it’s not fair to blame price declines on them solely.

CONS OF ACCELERATING COIN EMISSION

The inflation of Firo’s coin emission goes back to pre-halving days (though note that the high emission didn’t hurt Firo’s growth in those initial 4 years) though it is arguable that the allocation is much more fair without seed investors and now a community fund.

There is also an assumption that masternode holders are loyal Firo members who will channel their rewards to support the project. We are seeing some of these with the donations (which come from many known masternode holders) but it is far below the number of masternode holders that we have.

The 2nd drawback is that for those that believe tokenomics should never change (for eg Bitcoin maxi types), this now sets a precedent that Firo can change its tokenomics. For some, cryptocurrency rules should be set from the beginning and never changed or else it’ll be subject to politics and outside influences.

TAIL EMISSION

This was discussed in other threads but I strongly believe in the need of a small tail emission (<1% a year). The idea that miners/masternodes can be sustained purely from a fee market to me is a bit of hopium. Over the next few years (maybe in two halvings?) unless Bitcoin continues going parabolic in price, miners will soon find themselves in a tough spot.

There is a Princeton study on it.

On the instability of Bitcoin without the block reward. You can also read Decrypt’s article on it.

For the sake of counter-argument, you can read Dan Hedl’s (a well known Bitcoin maxi) opinions on why he thinks this isn’t a problem.

I think this is an excellent time to consider the tail emission and also in the future dynamic blocks.