Btw, for the tail emission, please read this thread I wrote on Twitter:

An observation: Most agree that $LUNA / $UST failed because of a flawed design that they should have known about or that was ‘working as intended’. What if I told you #Bitcoin $BTC also has a flaw in its design as well because of its 21M limit?

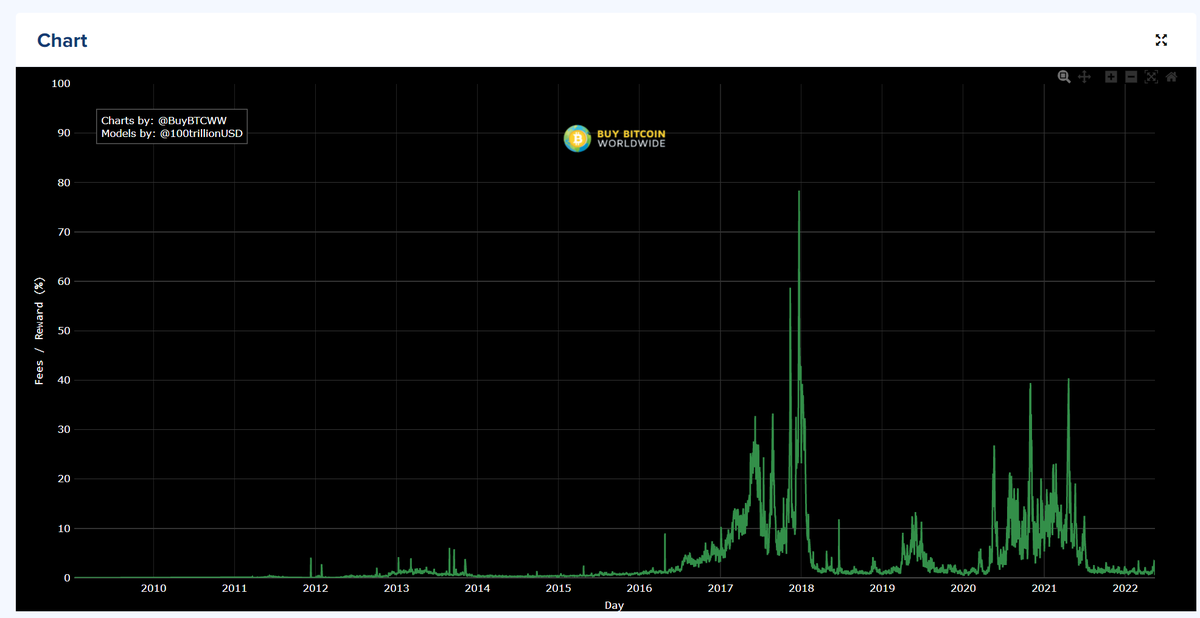

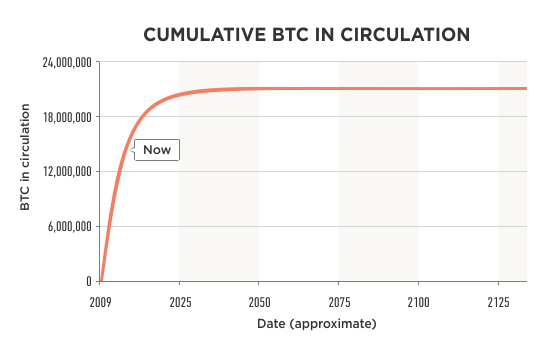

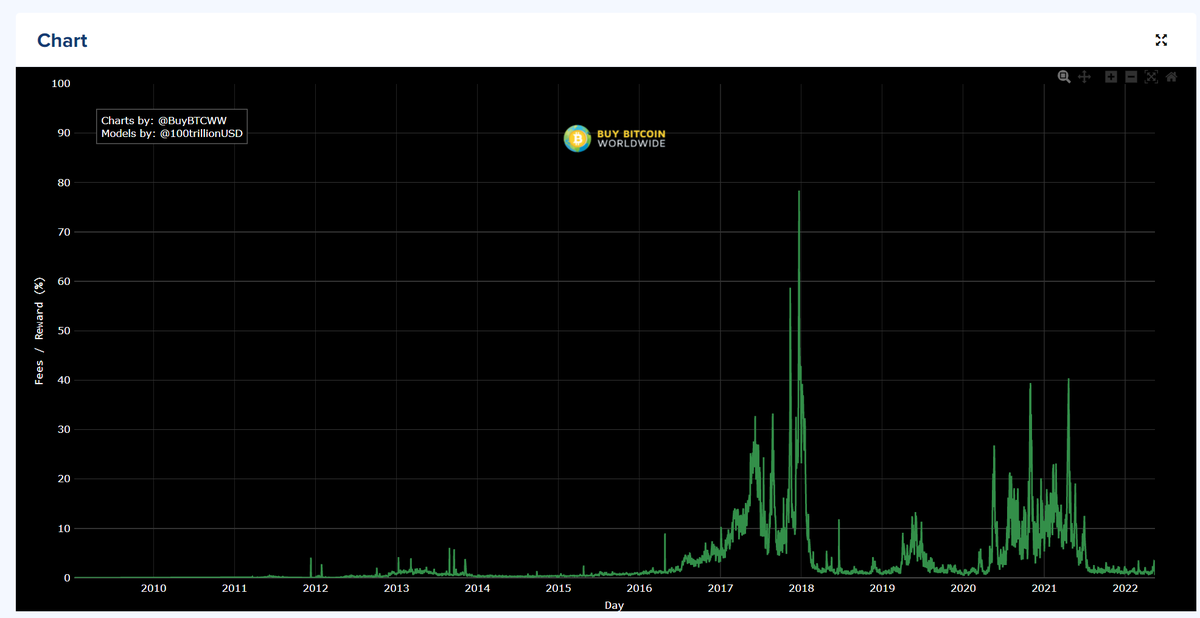

Bitcoin’s security relies on miners securing it. Miners are paid by emissions (block rewards) and by fees. Every ~4 years, this emission halves and trends towards 0. The idea is that eventually miners will have their earnings completely in fees.

This thinking has several problems. First it assumes that fees alone would be sufficient to incentivize miners. The data shows that fees as a percent of the entire reward has been dropping. stats.buybitcoinworldwide.com/fees-percent-o…

https://stats.buybitcoinworldwide.com/fees-percent-of-reward/

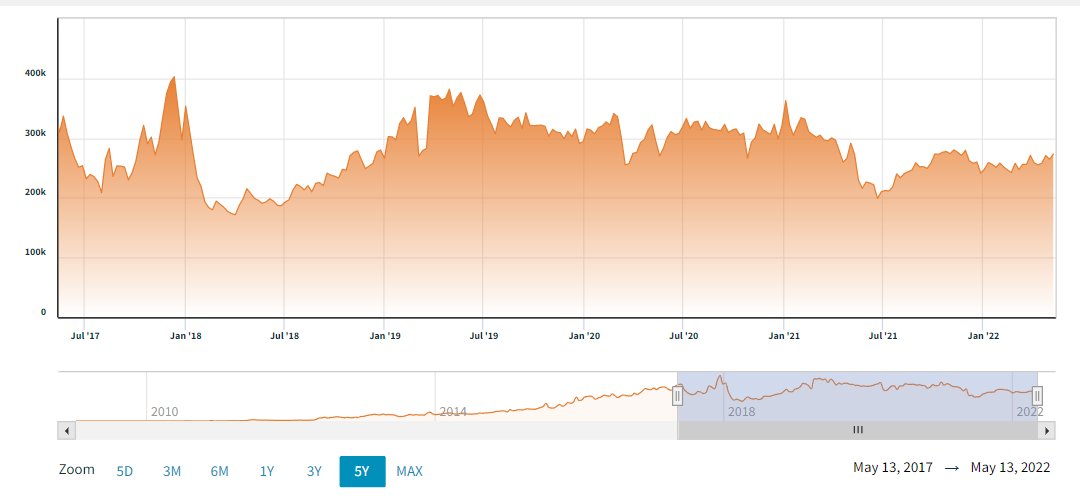

Now I understand the counter argument which is true that because of increased Segwit adoption, there is an effective increase in block space and therefore it is normal to see this drop. But let’s look at another metric: the number of daily on-chain transactions.

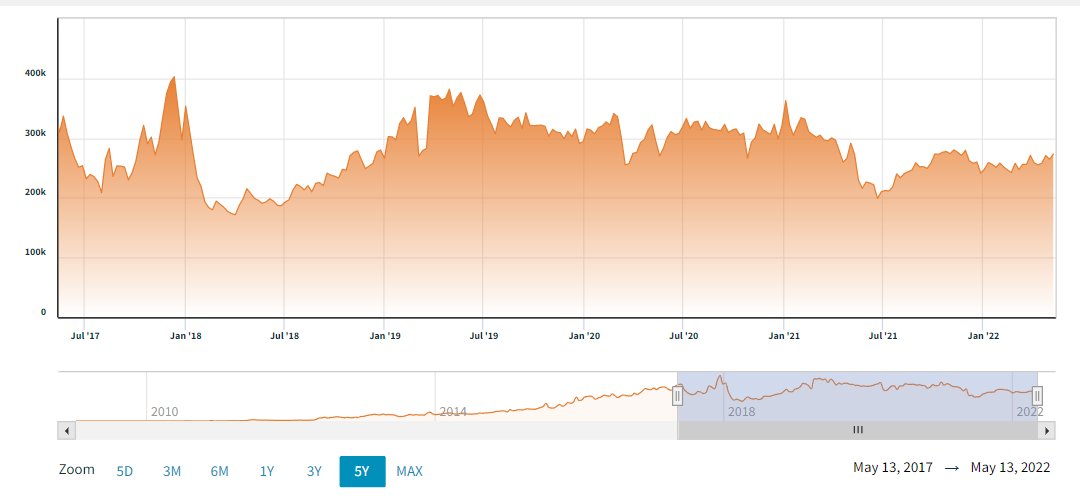

As we can see, despite record adoption and user numbers, the number of Bitcoin transactions which measures on-chain activity has also not been growing for the past 5 years. data.nasdaq.com/data/BCHAIN/NT…

You may say, well this is because of the Lightning Network! Well, this doesn’t affect the problem at hand because miners don’t make any money from Lightning Network transactions: only channel opening/closing.

What is more likely is that while adoption has increased many still use exchanges to hold their coins and internal exchange transfers also serve as a kind of ‘scaling’. $ETH / alt L1s taking over the role of colored coins / OMNI USDT, etc have also has relieved this.

Bitcoin’s price has generally more than doubled after each halving so miners haven’t really felt the problem yet since while they get less coins, the USD value is still more. But this can’t be forever. There will come a point where $BTC becomes like a global commodity.

The problem with relying on fees alone is it means that the security of Bitcoin is then totally dependent on how much the blockchain is used. We have seen that there are ebbs and flows in Bitcoin transaction numbers regardless of the total market cap of Bitcoin

During frothy bull markets, transaction volumes go up, in bear markets, there’s a lot of spare capacity. However because miners currently still enjoy block rewards, they can continue mining consistently and plan in the knowledge that they will earn something.

Without block rewards, there can be massive variability in their earnings which has severe consequences on security. In fact there’s a Princeton study on it: “On the Instability of Bitcoin without the Block Reward”

Without a block reward, security is no longer tied to the amount of value secured by Bitcoin, it is tied to the amount of transactions that is transacted in Bitcoin which is a HUGE DIFFERENCE.

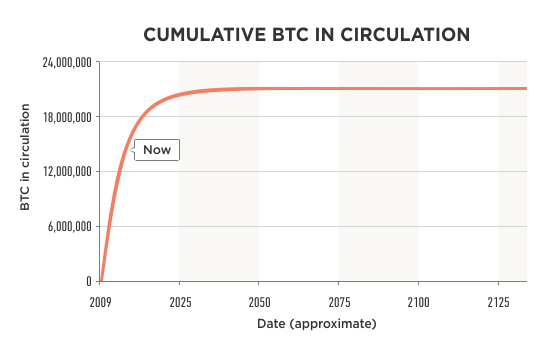

Some might argue, “well Bitcoin will still emit until year 2140” so we’re still good, we have time. Well even in 2030, there’s actually hardly any emissions left. It might as well be as good as 0.

Now of course, if Bitcoin’s price forever goes up, then all of this is fine, Even the small amounts of emission would be enough as long as the price increase is more than the effect of halvings. Guess what is also fine if it forever goes up? $LUNA $UST

While there might be several ways to deal with it, the simplest way would be to implement a tail emission such as what $XMR has done. This means there will forever be a steady base level of rewards that would be roughly tied to the value it secures.

The problem is the whole cult over “deflationary”, “limited max supply”, “21m coins only” and “infinite supply” which makes this difficult to implement on $BTC. Let’s debunk some of these.

Bitcoin currently is deflationary because it has increased purchasing power over time. But technically in terms of Bitcoins emitted it is still inflationary until 2140. It means as long as price goes up it is deflationary but if it stagnates then it’s inflationary.

There’s a difference between a fixed inflation rate vs arbitrary or massive inflation. Tail emissions are a fixed inflation rate. Stuff like $LUNA or $USD where new money is printed in massive amounts cannot be considered the same.

$LUNA’s printing is dictated by an algorithm in relation to the price of $UST while $USD’s printing is dictated by the Fed. Tail emission in comparison is dictated by a rule agreed upon by the community at large and can only be changed with wide consensus.

So while technically $LUNA or coins that have tail emissions like $XMR both have ‘infinite supply’ they are TOTALLY DIFFERENT THINGS. The key is not ‘infinite supply’ but the rate of inflation and who gets to determine it.

Don’t get me wrong, I want Bitcoin to succeed and have a good portion of my net worth in it. But whether I keep it there depends on whether the greater Bitcoin community will acknowledge its shortcomings and think it through themselves rather than parroting catchy shortcuts.

Don’t let market size lull you into a false sense of security as we have seen it can all come crashing down in an instant. The problem with $LUNA and $BTC is of course different but should be a warning nevertheless.