I have been thinking about this issue for a while and wanted to gauge community feedback on Firo’s long term direction. We have our roadmap clear at least in the short-middle term to deliver on Spark and improve the user experience and Spark address use. I’m pretty proud on this and as a community I think it’s really something to celebrate that we can continue to push out good work.

With Spark Assets coming, a big question now arises as to the direction of the project. The introduction of Spark assets means we are moving to becoming a privacy ecosystem rather than just a cryptocurrency for private payments. We want other people to be building on our chain and creating tokens for all sorts of different things.

The problem with doing this in isolation just on Firo’s existing blockchain is that we are in a bit of an island. In an industry where you are competing with L1s that have 100s of millions of dollars to incentivize builders and projects to build on them, Firo does not have similar incentives nor do we have a large enough community to have a network effect. Solana achieved a lot of traction due to its attractive grants/funding despite being non EVM but its activity also dropped off post FTX and while activity is still happening, it remains to be seen if it can recover its earlier heights.

Even communities that do have some network effect also struggle with this. Ravencoin to me is also an example of a project that made ‘token issuance’ as a focus but we aren’t seeing any meaningful up take in that utility. Bitcoin Cash also has attempted this and similarly has developed an EVM compatible sidechain called smartBCH which also seems to have gone relatively inactive. Another project I follow Radix has developed a whole new safer programming language with a blazing fast consensus mechanism but yet has only attracted about 21m in TVL. Our friends at Beam similarly has built out its privacy ecosystem along with its own decentralized stablecoin but only sees 478k USD in TVL and a couple of hundred dollars in volume.

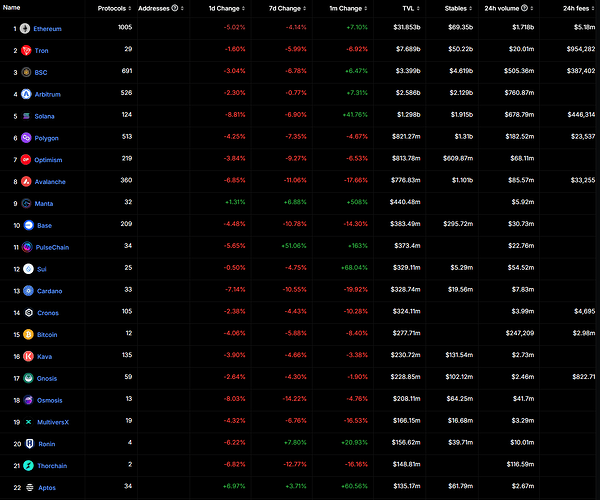

On the other hand, Ethereum and EVM ecosystems continues to remain the leader in market share despite its limitations. The reason is because of mature and active DeFi protocols there along with a whole ecosystem of active users. Let’s take a look at TVL metrics:

The last thing I want is to spend a lot of time on building out Spats only to see a ghost town despite its capabilities.

So we have a few options here (these all require more research and are based off cursory examination):

- Remain Firo’s current blockchain and build out Spats independently: This is basically the Zano/Beam approach. This has the least overhead and least risky technically. Bridging over assets may be more complicated or require custodial solutions. This was the original plan.

- Don’t build out Spats, focus on Firo as for payments and optimizations to user experience and tech upgrades (such as Curve Trees).

- Maintain a sidechain similar to the SmartBCH model with minimum privacy but has Defi primitives and much easier bridging of assets. However this doesn’t really utilize Spark and is a big question mark whether users will use Firo’s main chain even if the sidechain takes off. We can possibly use it as a liquidity gateway to Firo’s main chain.

- Become a chain that supports Cosmos IBC. This is the route that SCRT has adopted and has some moderate success (20m TVL). This requires quite a bit of work and the validator set is relatively centralized. Open questions on how to do this with Cosmos account model.

- Become an Ethereum L2. This allows to gain mindshare by tapping into the Ethereum ecosystem. However can be quite complex also and would need a lot of reskilling of existing developers. There are opportunities to do this using a UTXO model (such as Fuel Labs).

- Become another L1 but with EVM, with UTXO support/Spark. This allows us to retain independence of validators but means also a lot more stuff that needs to be built around it. This is similar to Polygon (without UTXO).

I may be wrong about the options above and open to hearing from other experts on the matter.

Options 4,5 and 6 require a lot of work and probably a change in team and funding. It also throws a way a lot of the work already done and is akin to a new project. It also introduces a lot of migration headaches.

To make option 4,5 and 6 viable, it would require an additional funding raise. One idea is to utilize the unissued portion of Firo to do this with a reasonable vesting cycle. This would not change the overall supply but would mean that we are no longer following the issuance cycle of Bitcoin (which to me is outdated anyway). It does make us more ‘VC’ investor based though but at the same time might attract more funding and activity. Or we can be more flexible and use this as a way to align incentives better while protecting existing Firo holders.

I don’t have any particular personal preference currently as each have their own pros and cons.

I am engaging a preliminary study to evaluate these options in details so I can come up with a more educated post and summary on these options but still wanted to gauge preliminary community appetite to this.

Things to Factor in

- Ease of bridging tokens from other ecosystems

- Ease of creation of AMMs/internal DEX

- Compatibility with Spark/Spark Assets technology

- How censorship resistant is the consensus/security mechanism

- Amount of work + team changes required

- Additional Funding required?

- Replacement of role of masternodes