Hey! I welcome these discussions and thank you for the time you took to write this. Let me address them the best I can

Masternodes and their Role

So first of all I don’t think just rejigging the masternode rewards will do much. During the early years, masternodes was a new concept with the concept of passive income being attractive which is why it took off like a rocket. It was a powerful narrative then. Unfortunately after the 2018 cycle, masternodes are no longer sexy and seen as a relic of the past like most crypto fads such as yield farms etc.

Does this make the system automatically bad? Not really. It has its limitations but the hybrid system does a good job of balancing security, fair distribution and having the community earn rewards. While there are more advanced consensus mechanisms out there, they involve a good degree amount of work for only marginal benefit so personally I don’t see any urgency in moving away from the current hybrid system.

Creating additional nodes and further punishing smaller holders to me is idealogically wrong and doesn’t create any additional utility or benefit. Remember, the halving and even slashing the miners and increasing masternode share did nothing to price.

Sell pressure

Miner sell rewards hardly affect the market. While they as a group aren’t vocal participants in the community, there’s a beauty of being able to get your coins without any permission or prior holdings required especially as a privacy focused project. The sell pressure that they exert is miniscule even with the reduced volumes. People forget that % of block reward is not the same as % of supply especially since we’ve gone through a halving.

One interesting way to replace miners is maybe through merge-mining whereby we align ourselves with a PoW coin with an active and privacy oriented community (such as maybe Monero) though @sproxet will scream at me  It is important that our miners care about what we’re building!

It is important that our miners care about what we’re building!

I also saw a comment that core team is imposing sell pressure. While this is of course technically true, 16000 FIRO from core team and let’s say 14K Firo from community fund is like 30k FIRO a month which is like 44k USD sell pressure a month (which covers all operations). Something that can easily be absorbed in half a day by the market. Note that the way the core team sells is always through small maker orders of 200-400 FIRO meaning there is no dump. It means that core team puts the order to sell, and someone buys it rather than us taking someone else’s buy order. The biggest sell pressure are from old holders especially during an extended bear market when people are hurting.

A Primer on Market-making

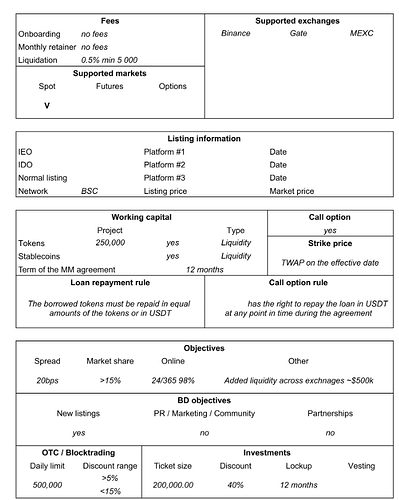

As for market making, I’ve explained this before there are basically two primary models that market makers work:

a) retainer model

b) option model

Retainer model is straight forward, you pay them a couple of thousand USD/month and they deploy your capital and fill the books up and encourage trading. Generally this is market neutral.

Option model is different, you loan them your inventory for free and they trade with it freely. They don’t charge you a fee. In return you grant them a call option to buy at a certain price.

They also have the ability to choose whether to pay you back in native FIRO or stablecoin whichever is favorable to them. If the FIRO price is lower than they started, they return to you the FIRO which is now worth less. If the FIRO price is higher than they started, they repay the loan to you in stablecoin and pocket the change in FIRO. This effectively works as a free option both ways.

Investment also often comes with a discount inbuilt. Let me show you a sample proposal including from some of the firms that community has been “recommending us to work with”.

I’ll let you come to the conclusion whether market makers like these are aligned. Currently these are being proposed to many projects and those in distress have taken up these deals.

Another big risk of the option model is that they effectively have custody and control over your funds and what happens if they don’t deliver? Also don’t forget what happened to Alameda and 3AC.

The retainer model still allows the project to retain control of the funds (at least within the exchange accounts).

In the tradfi space, market makers generally work on retainer + performance bonus model and the metrics they are judged on are:

a) Depth of books

b) Spread

c) Volume

Note that none of these factor in price.

For projects where they have all the funds allocated up front to team/market makers/VCs and where there is no established market already, it’s easy for these market makers and VCs to prop up the price since there is little “public” to sell. In this case centralization of tokens is a huge boon here which is something this project does not have. Noob influencers or casual observers just look at the rich list and say ooh it’s heavily centralized without realizing that it’s because most of them are sitting on exchanges. This indicates a problem in aligning the community with the ideals of the project vs speculation.

Reasons of Price Decline

As is most things, a lot of it is multi factorial. However I don’t think the issue of masternodes or even dev tax are the main issues here.

Without going into the details (as otherwise this post would be too long) I’ll give a short summary:

a) 51% attack and disgruntled seed investor made us miss one bull cycle

b) Various vulnerabilities especially around Zerocoin shook confidence

c) Privacy as a narrative hasn’t really taken off yet and instead has faced regulatory pressure

d) Early on, we lost focus of our core mission which is privacy and instead divided attention into ASIC resistance and masternodes which made us slower than we would have liked

e) Rebrand and a strategic dump by seed investor during that time lost us the boost and brand recognition.

f) Over focus on tech without improving user experience or adoption.

I of course accept responsibility of my role in many of these and I’ve said it many times that I’m willing to step down should a suitable replacement be found. I mean this genuinely even though some may think I’m just saying this. It is after all my end goal to have the project run on its own legs. Firo is my love and although I have received lucrative opportunities to join new projects, I find great pride in the product, team and community we built despite the price and have an illogical attachment to it. A lot of my personal resources (not Firo’s) go into Firo, from the cost of the videos I do (regardless of reach), some staff, market making inventory and other things and it’s because I believe in the importance of our mission.

In this new economy that is surrounded by “attention” especially in crypto, narratives always shift. Remember when some of you said we should go into metaverse or gaming?

Moving Forward

Some have expressed that Firo should give up privacy and change narrative. While that is possible, I wouldn’t be the right person to lead it then. I still sincerely believe in the importance of it and that one day this narrative will come to the fore. With increasing discussions on CBDC, Tornado Cash and increasing distrust in governments and corporations, I do think that privacy’s time will come and it is our time to position ourselves for that time when it happens.

For those who do want to pivot away from privacy makes me ask, why were you here in the first place when it was very clear what our mission was despite the obvious risks? Despite other influencers or project leads, I have never asked people to invest or buy Firo.

Right now I’m focused on delivering the promised Spark upgrade that would give a very strong foundation of privacy. If the community permits, I would then focus on the development of Spark Assets and a privacy token ecosystem to expand the use cases of Firo to be more than just a coin but a privacy ecosystem. While there are others that do this, they often take short cuts like proprietary hardware (TEE) or use custodial options to offer bridging.

Another route is to focus more on adoption and UX efforts which is something I am hoping to do after Spark launch. This means much more reliance on light wallets and user interface and getting it smooth and a pleasure to use. This is something I meant to do a lot earlier but had to prioritize Spark over this.

But that being said, despite the doom and gloom, there’s a lot to be proud about. We have lasted longer than many projects that have raised many millions of dollars. We maintain strong exchange listings and actually quite healthy liquidity. We have many valuable integrations and partnerships. We have built some of the most important privacy protocols even ones that have inspired other projects and continue to be at the forefront of this. We’ve actually gained a lot of new supporters who are privacy aligned from the Monero, Beam and Epic Cash communities. I would like to continue this mission if the community permits but it requires both the community and core team to be aligned with each other. I apologize if I’ve not been as vocal or present as before but I can assure you Firo is at the forefront of my priorities everyday.

We have many valuable community members and even the criticisms are welcome as long as they’re constructive. It means you care enough to give a shit to write something here which is why I think it’s important I write this. We are a project for the people and that means the people need to work on this. Not some pipe dream of selling out to a VC or getting into a deal with the devil with some market maker whose interests are just to profit off our inventory and options.