A new proposal has been posted to the Firo Crowdfunding System.

- Title: Funding FiroDex Liquidity Pool

- Author: Fiendish

- Proposal type: Miscellaneous

- Link: click here

Use this topic to discuss this proposal!

A new proposal has been posted to the Firo Crowdfunding System.

Use this topic to discuss this proposal!

Funding target changed from ‘50.0 FIRO’ to ‘50000.0 FIRO’

Sounds like a good idea to me, a good place to store the excess funds that are not used. I guess it will also give some profits back to the community fund.

Doesn’t necessarily create profits as for part of the FIRO would need to be converted to the other pairs we want to support. The quote would however be 1% over CEX to cover fees and earn a little bit of arb.

Funding target changed from ‘50000.0 FIRO’ to ‘10000.0 FIRO’

Update:

In accordance with CFC deliberations. The maximum Firo liquidity amount has been revised down to 10,000 Firo. Any increases will need to be voted on by CFC.

8500 out of the total 10,000 has been funded.

Will complete funding once the FCF has accumulated enough over the next few days.

Interresting, maybe the maximum firo quantity could be ajusted later. Its a good idea to test the water first.

One quick question, is there financial implication for the community? I mean, if there is some profit or lost (capital gain, capital lost, etc), usually, that mean that someone somewhere has to declare that to his government. I know @reuben use to be a lawyer, how does it work for those liquidity pool? Will those actions of improving liquidy will be done under someone’s name?

Status changed from ‘Funding Required’ to ‘WIP’

Payment of 10000.00117687 FIRO sent

As decided by the CFC, this proposal will now be used to provide liquidity on Pancakeswap for BEP20 FIRO liquidity with BNB. Reason being FiroDEX needs are currently being met and much more usage of BEP20 FIRO as an onboarding into FIRO proper.

The funds have been transferred to Binance. Will update the LP and addresses for everyone to monitor here later.

This is a bit of an unclear situation but where I am, capital gains are not taxable.

But there is a financial risk in the sense of

a) Smart contract risk (if Pancakeswap has a vulnerability)

b) Wallet risk (if our wallet get hacked somehow, I’ll be using a hardware wallet).

c) Fluctuation of price of assets (because crypto fluctuates)

d) Impermanent loss (as is normal per these AMM models)

https://bscscan.com/tx/0x49ba05d1821cd78c716c6ea53b3343475ff0bc71d0881c40c9cdda81f643f2b0

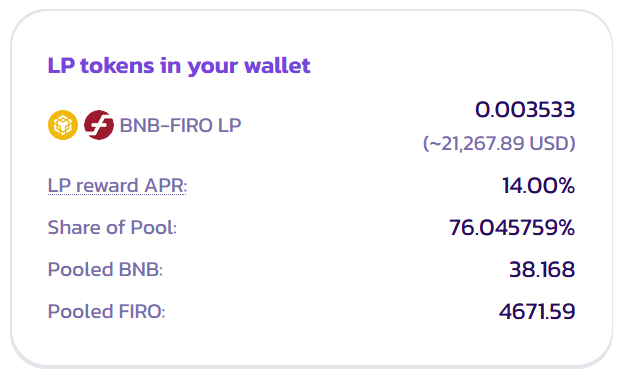

This is the txid providing LP to Pancakeswap.

I had to convert a bit more to BNB to rebalance the pool but it should be there approximately. The FCF forms ~76% of the pool currently.

Status changed from ‘WIP’ to ‘Completed’

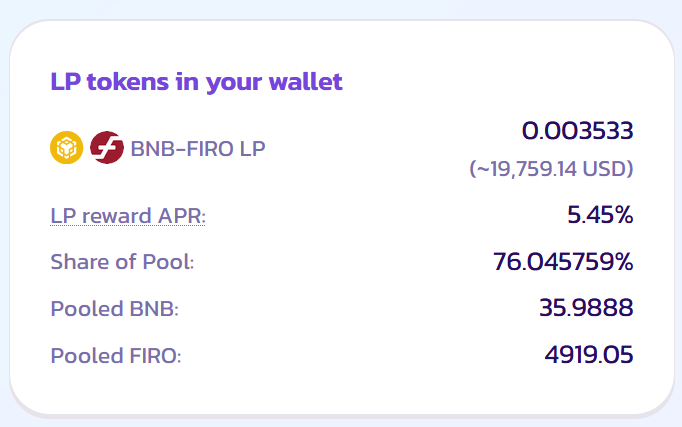

Usage of Pancakeswap has increased and you can see an increase in the LP APR.

Share of the pool remains unchanged.